Del Monte Files for Bankruptcy: The Rise of Private Labels

It’s officially the end of an era.

Two weeks ago, the agricultural and packaged goods F&B giant, Del Monte, filed for bankruptcy citing declining demand resulting in increased costs related to surplus inventory and, subsequently, increased promotional activity. For decades, national brands would bask in their brand leadership knowing that private labels were not just of lesser quality but were also perceived as an inferior option that carried heavy stigma for those who purchased them. Not so much anymore!

According to the Private Label Manufacturers Association, private label sales rose in the US by nearly 4% last year to reach a record USD 271 billion. While unit sales of store brands have barely grown sin the last 4 years (a very modest 2%), national brand unit sales fell off the cliff by 7% over the same period. Private labels are not only evolving into more sophisticated consumer brands that meet consumer preferences and requirement but also deliver 25-30% higher gross profit margins compared to national brands. This is particularly true in turbulent economic times, which haven’t really changed much since the world was turned upside down by the global pandemic and subsequent inflation and supply chain volatility.

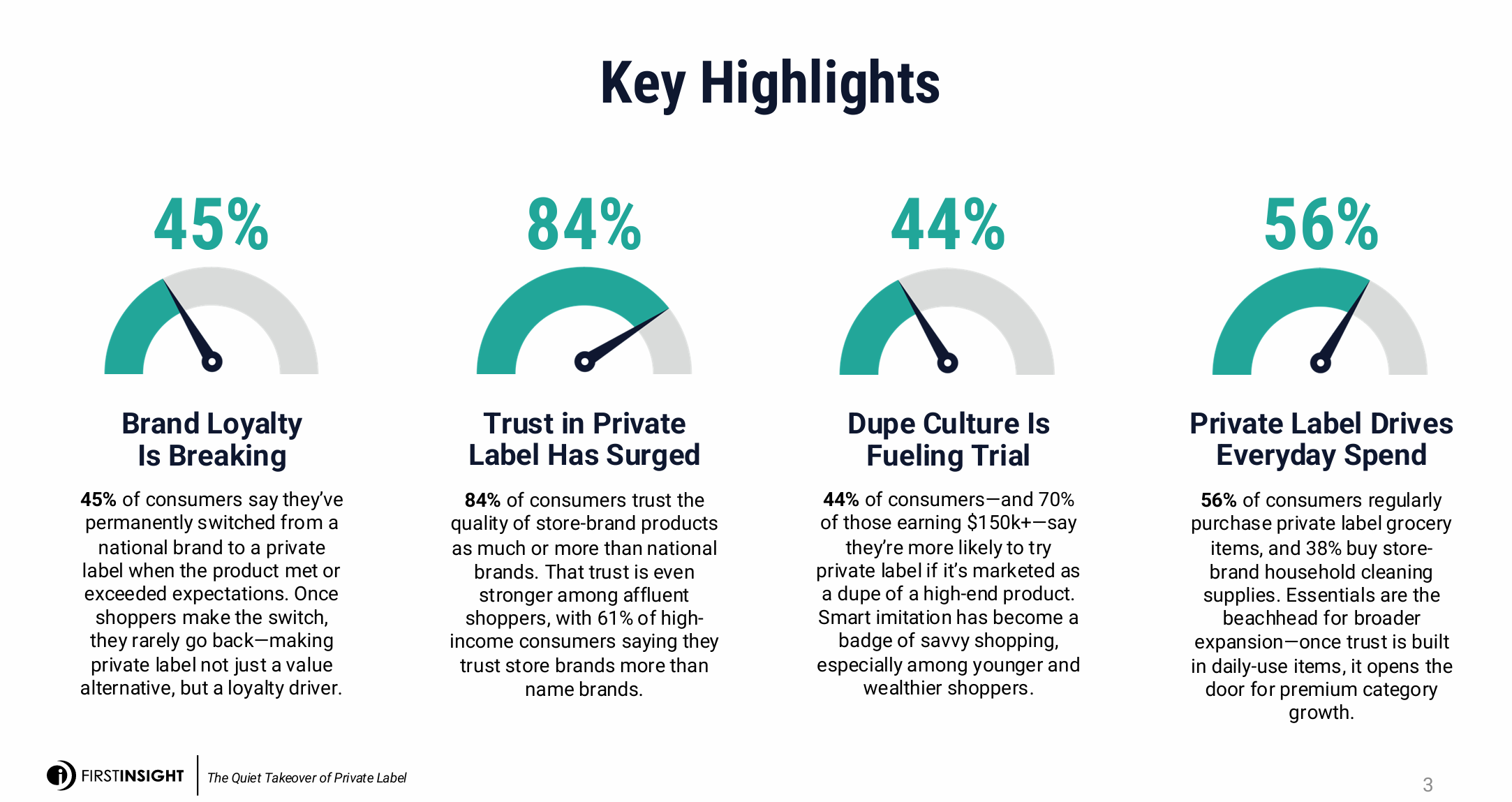

Some of the key findings from First Insight, reveal that brand loyalty is faltering; trust in Private Labels have surged; infamous dupe culture often fuels product trials; and Private Label drives every day spend.

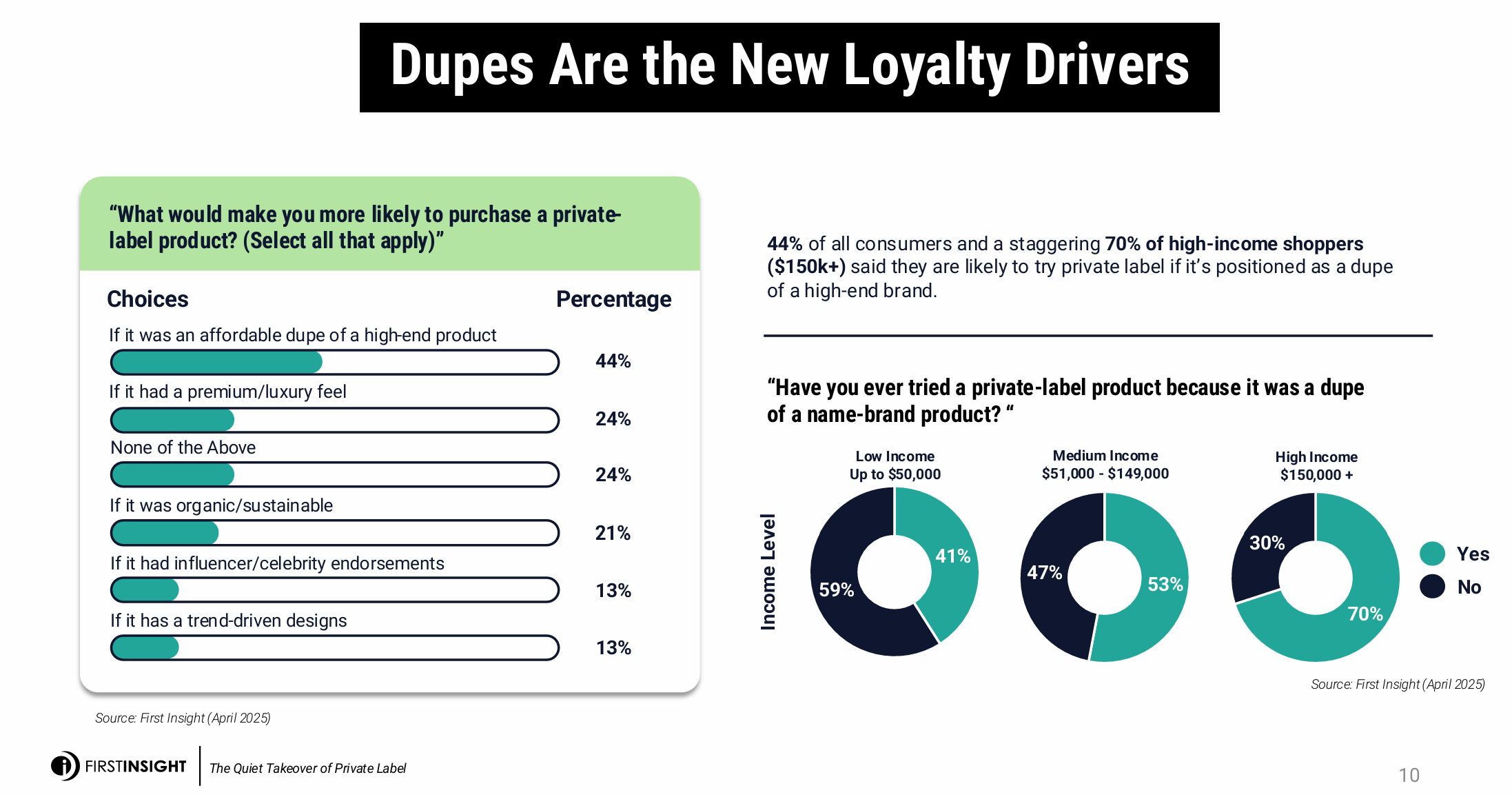

Unsurprisingly, cash-strapped Gen Z have been leading the growth of private labels. Over 50% of Gen Z shoppers reported choosing where to shop based on store brands. Whether it’s fashion, cosmetics, or tech, younger consumers are keen participants of dupe culture. What is interesting, though, is that this behavior has now extended to high-income consumers who said trusting store brands over national brands. The rise of private label over store brands is no longer a trend, it’s a shift. Having said that, marketing has evolved so much since our parents occasionally bought the odd can of Great Value tomatoes, that most shoppers cannot tell the difference between a store and a national brand.

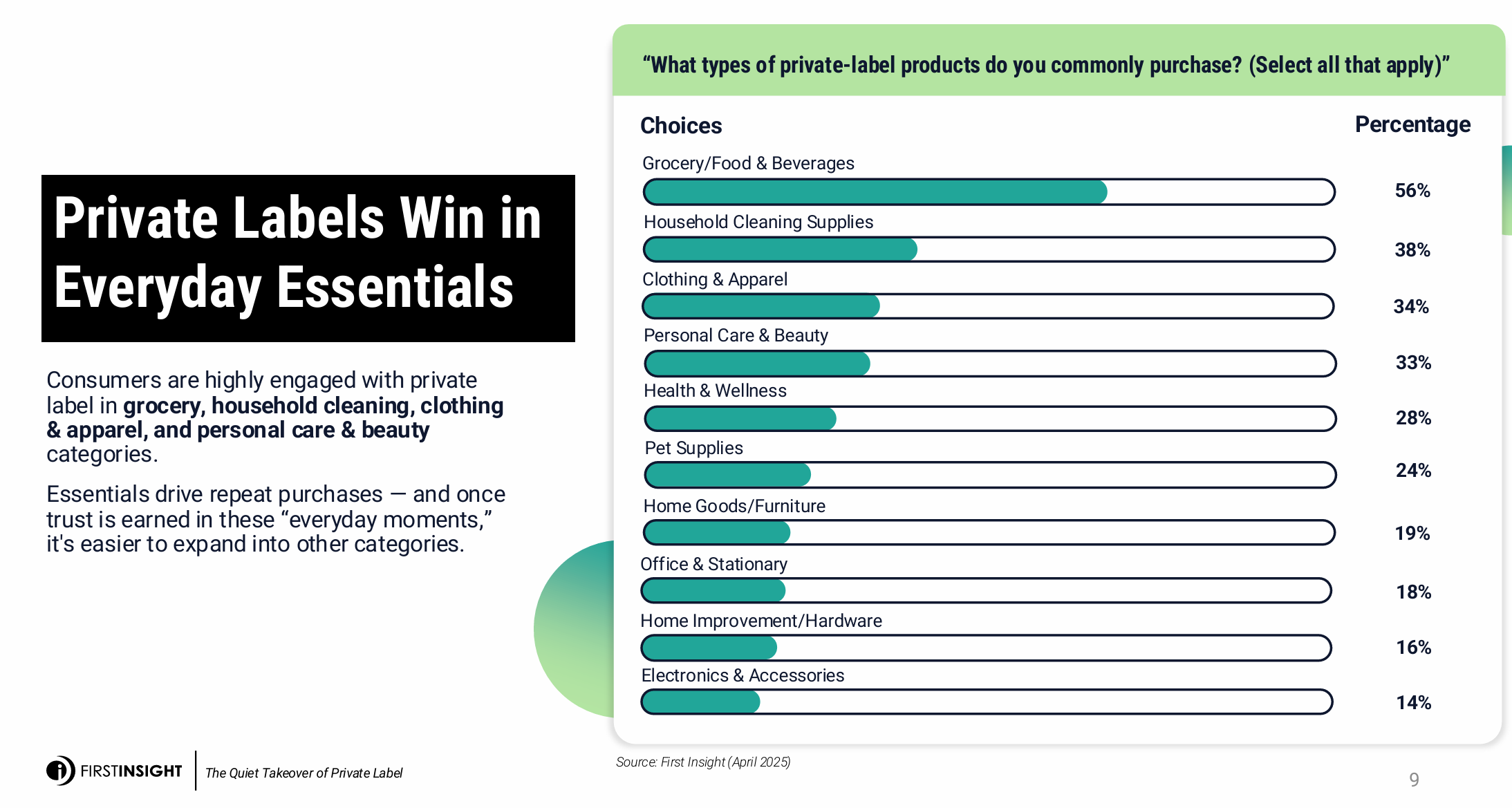

The growth of private labels, whilst impressive, is uneven. Groceries and household cleaning supplies lead category growth with 56% and 38% of the respondents reportedly purchasing store over national brands more frequently. It is interesting, that whilst shoppers are more likely to choose private label brands for groceries, they are less likely to do so for pet supplies.